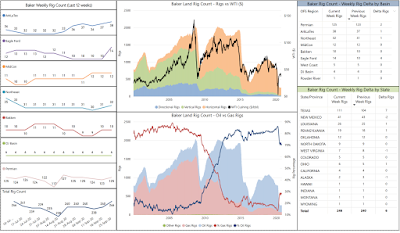

This week, the US Land Rig Count increased 13 rigs this week to 267 active rigs. The ArkLaTex and Bakken each added one rig, the MidCon added 2 rigs, and the Eagle Ford added 5 rigs. The Permian was flat while the DJ Basin was down one rig.

Since the low point of 230 rigs on the week of August 14, the rig count has increased 16%. After the low point, the rig count skipped along the bottom for several weeks as the market continued to adjust to lower prices. Over the last 6 weeks, we have seen the rig count increase in most areas as operators returned to drilling.

With Q3 results coming out over the next several weeks, we should learn about plans for Q4 and the start of 2021.

|

| Figure 1: Baker Hughes US Land Weekly Rig Count - Oct 16 2020 (Source: Baker Hughes) |

|

| Table 1: Baker Hughes US Land Weekly Rig Count - Oct 16 2020 (Source: Baker Hughes) |