While this is a positive sign that the industry has reached a low point in activity, we will probably be bouncing along this trough for a while. There is a lot of uncertainty about the impact of a second wave of COVID-19 and the weakness in future prices due to OPEC+ supply increases. The market will remain volatile for the remainder of 2020

Friday, July 31, 2020

Baker Hughes Weekly US Land Rig Count - July 31 2020

For the first week since March 20, the weekly US Land rig count did not decline week over week. The Baker Hughes Weekly Rig Count showed that the US Land Rig Count stayed at 239 rigs. The Permian was down 2 rigs but the Midcon and Bakken each added a rig.

Thursday, July 30, 2020

RigZone.Com -Natural Gas Could Blaze Trail for Hydrogen

(Bloomberg) -- For a glimpse into the future of a hydrogen-fueled world, look no further than natural gas and the technology that rapidly transformed it into a global commodity.

Rystad Energy - A CLOSER LOOK at the Bakken/Three Forks Shale Play

In addition to frequent press releases and morning comments, Rystad Energy is starting a new line of media publications, called ‘A CLOSER LOOK’. In this communication series we will offer a glimpse of our in-depth monthly regional reports, highlighting trends and providing an outlook on production and spending, among other interesting data findings.

Wednesday, July 29, 2020

OilPrice.com - Why Oil Remains Stuck At $40

Oil prices posted gains once again on Wednesday on the back of bullish data from the EIA, but analysts are warning that plenty of downside risks remain. The EIA reported a huge drawdown in crude inventories on Wednesday, with a drop of 10.6 million barrels. That was enough to lift crude prices.

But several analysts argued this week that the bigger picture is murkier, with economic and pandemic-related risks looming. “While upwards momentum has stalled over the past month, we still think prices are overdue a downwards correction to reflect the flattening of oil demand recovery and the darkening of economic prospects,” Standard Chartered analysts wrote in a note. The investment bank added that “consensus views” on the oil market balances in the second half of the year have “weakened significantly over the past month.”

https://oilprice.com/Energy/Oil-Prices/Why-Oil-Remains-Stuck-At-40.html

But several analysts argued this week that the bigger picture is murkier, with economic and pandemic-related risks looming. “While upwards momentum has stalled over the past month, we still think prices are overdue a downwards correction to reflect the flattening of oil demand recovery and the darkening of economic prospects,” Standard Chartered analysts wrote in a note. The investment bank added that “consensus views” on the oil market balances in the second half of the year have “weakened significantly over the past month.”

https://oilprice.com/Energy/Oil-Prices/Why-Oil-Remains-Stuck-At-40.html

JPT - Tomorrow’s US Fracturing Fleet Will Be Smaller Than Usual, but Better Than Ever

In its latest analysis of the US onshore sector, consulting and market research firm Rystad Energy said that the recent 55% drop in annual spending by shale producers has accelerated a major transformation of the pressure-pumping business.

It is to become a more efficient business, however, margins will be ever tighter as pressure-pumping firms compete for smaller slices of a shrunken market. Among Rystad’s key projections is that active pressure-pumping fleets in the US will remain at historically low numbers for at least the next 3 years and possibly longer.

“There’s been a structural shift down in demand,” said Thomas Jacob, a vice president with Rystad. Speaking during the 2020 Unconventional Resources Technology Conference (URTeC) that was held online for the first time ever, Jacob emphasized that to see the bigger picture one needs to look beyond today’s low oil prices.

https://pubs.spe.org/en/jpt/jpt-article-detail/?art=7411

It is to become a more efficient business, however, margins will be ever tighter as pressure-pumping firms compete for smaller slices of a shrunken market. Among Rystad’s key projections is that active pressure-pumping fleets in the US will remain at historically low numbers for at least the next 3 years and possibly longer.

“There’s been a structural shift down in demand,” said Thomas Jacob, a vice president with Rystad. Speaking during the 2020 Unconventional Resources Technology Conference (URTeC) that was held online for the first time ever, Jacob emphasized that to see the bigger picture one needs to look beyond today’s low oil prices.

https://pubs.spe.org/en/jpt/jpt-article-detail/?art=7411

SPE Oil and Gas Facilities - What Are the Market Drivers for a Recovery?

The crude oil and natural gas markets may recover in 2020, but the speed of recovery in terms of pricing will be different. The crude oil market is rebalancing following a recent mild price recovery, but an increase in COVID-19 cases remains cause for concern. Natural gas may not recover until winter 2020/2021 as low prices, weak demand, and ample storage weigh on the industry.

“Each of (the markets) has very different dynamics going on, but they are definitely being impacted by pandemic and demand destruction trends,” said Enverus VP of Strategic Analytics Bernadette Johnson.

Speaking during the virtual 2020 Unconventional Resources Technology Conference (URTeC), Johnson outlined key drivers for the markets.

https://pubs.spe.org/en/ogf/ogf-article-detail/?art=7418

“Each of (the markets) has very different dynamics going on, but they are definitely being impacted by pandemic and demand destruction trends,” said Enverus VP of Strategic Analytics Bernadette Johnson.

Speaking during the virtual 2020 Unconventional Resources Technology Conference (URTeC), Johnson outlined key drivers for the markets.

https://pubs.spe.org/en/ogf/ogf-article-detail/?art=7418

Monday, July 27, 2020

Rystad Energy - A mild second wave of Covid-19 is now Rystad Energy’s base case scenario for oil demand

As Covid-19 infections continue to increase around the world and the implications of the pandemic’s spread are acknowledged in key markets in the Americas and Asia, Rystad Energy is now changing its base case scenario for oil demand, incorporating a mild second wave effect.

The updated base case scenario assumes a temporary pause in global demand recovery, as the reopening of Europe and other regions is offset by Covid-19 outbursts in populous and high oil-consuming countries in the Americas and Asia such as the United States, Brazil and India, among others.

There is downside risk to our base case. We have identified a category of oil demand at risk – that is, the maximum number of barrels that could be lost if a full lockdown is reinstated globally. In this worst-case scenario in which strict lockdown measures return, we expect demand to edge around 3.7 million bpd lower for the rest of 2020, compared to our updated base case scenario.

https://www.rystadenergy.com/newsevents/news/press-releases/a-mild-second-wave-of-covid-19-is-now-rystad-energys-base-case-scenario-for-oil-demand/

The updated base case scenario assumes a temporary pause in global demand recovery, as the reopening of Europe and other regions is offset by Covid-19 outbursts in populous and high oil-consuming countries in the Americas and Asia such as the United States, Brazil and India, among others.

There is downside risk to our base case. We have identified a category of oil demand at risk – that is, the maximum number of barrels that could be lost if a full lockdown is reinstated globally. In this worst-case scenario in which strict lockdown measures return, we expect demand to edge around 3.7 million bpd lower for the rest of 2020, compared to our updated base case scenario.

https://www.rystadenergy.com/newsevents/news/press-releases/a-mild-second-wave-of-covid-19-is-now-rystad-energys-base-case-scenario-for-oil-demand/

Rystad Energy - Frac is back: US fracking set for first monthly rise this year, the Permian is leading the recovery

The Covid-19 downturn has caused a shocking decline in new fracking operations in the US, with monthly numbers plunging to a bottom of just 325 wells in June. A Rystad Energy analysis shows that new operations are now set to rise to above 400 wells in July, and recovery will be especially evident in the Permian Basin, where activity has nearly tripled.

Rystad Energy’s well count comes from both our own satellite data analysis and from our tabulation of FracFocus numbers. Our satellite data shows 246 newly started frac jobs this month, with 96 frac jobs beginning just last week.

https://www.rystadenergy.com/newsevents/news/press-releases/frac-is-back-us-fracking-set-for-first-monthly-rise-this-year-the-permian-is-leading-the-recovery/

Rystad Energy’s well count comes from both our own satellite data analysis and from our tabulation of FracFocus numbers. Our satellite data shows 246 newly started frac jobs this month, with 96 frac jobs beginning just last week.

https://www.rystadenergy.com/newsevents/news/press-releases/frac-is-back-us-fracking-set-for-first-monthly-rise-this-year-the-permian-is-leading-the-recovery/

Friday, July 24, 2020

Baker Hughes Weekly US Land Rig Count - July 24 2020

This week, the Baker Hughes US Land Rig Count showed that the rig count decreased by 2 rigs to fall to 239 active rigs. On a positive note, the Permian Basin added 2 rigs, ending 18 straight weeks of decreasing rig activity. The Northeast lost 2 rigs and the ArkLaTex region lost 1 rig. The state of Texas was net negative for the week with 1 rig addition in West Texas but a loss of 1 rig in South Texas and East Texas.

There is still room for fluctuations in the rig count but this is likely the bottom of the cycle. Other rig count sources have shown an increase in rig count this week but those are paid for services and I cannot show them. There will always be differences in rig counts between service providers. I will continue to use the Baker Hughes rig count due to availability and deep history of data.

There is still room for fluctuations in the rig count but this is likely the bottom of the cycle. Other rig count sources have shown an increase in rig count this week but those are paid for services and I cannot show them. There will always be differences in rig counts between service providers. I will continue to use the Baker Hughes rig count due to availability and deep history of data.

|

| Figure 1: Baker Hughes US Land Weekly Rig Count - July 24 2020 (Source: Baker Hughes) |

|

| Table 1: Baker Hughes US Land Weekly Rig Count - July 24 2020 (Source: Baker Hughes) |

|

| Table 2: Baker Hughes Weekly US Land Rig Count - July 24 2020 (Source: Baker Hughes) |

Wednesday, July 22, 2020

OilPrice.Com - The Beginning Of The End For Gas Flaring

The Texas Railroad Commission last month surprised many: it said it would tighten the rules for gas flaring at oil fields later this year. Texas is certainly not the state with the best environmental policies record for obvious reasons. After all, it is the largest single producer of oil in the United States. But gas flaring literally wastes billions of dollars.

Perhaps the time has come to stop the waste.

Every year, the oil and gas industry flares some 140 billion cubic meters of natural gas. The reasons vary: at oil fields, gas is flared when there are no pipelines to transport it to a collection or storage hub; at refineries, some gases need to be flared to avoid explosions.

https://oilprice.com/Energy/Energy-General/The-Beginning-Of-The-End-For-Gas-Flaring.html

Perhaps the time has come to stop the waste.

Every year, the oil and gas industry flares some 140 billion cubic meters of natural gas. The reasons vary: at oil fields, gas is flared when there are no pipelines to transport it to a collection or storage hub; at refineries, some gases need to be flared to avoid explosions.

https://oilprice.com/Energy/Energy-General/The-Beginning-Of-The-End-For-Gas-Flaring.html

Seeking Alpha - Renewable Energy Is Seizing Market Share During The Pandemic

Renewable energy has surged to capture a record share of global electricity generation, seizing more market share during the coronavirus downturn. The steep drop in electricity demand, down by more than a fifth in some parts of the world, has hit energy producers everywhere. But because renewable energy has zero variable costs – the sun and wind are free once solar and wind farms are constructed – coal and natural gas are often pushed out of the market first.

That has renewables holding up a bit better than oil, gas and coal. In fact, renewables in some places are seizing the opportunity, potentially accelerating the energy transition. For example, renewables accounted for 44 percent of power generation in the European Union in the second quarter, up sharply from 37.2 percent in the same period a year earlier, according to Reuters. “We are seeing figures we weren’t expecting to see for another 10 years,” Matti Rautkivi, director of strategy and business development at Finnish energy tech group Wartsila, told Reuters.

https://oilprice.com/Energy/Energy-General/The-Pandemic-Has-Been-A-Major-Boon-For-Renewable-Energy.html

That has renewables holding up a bit better than oil, gas and coal. In fact, renewables in some places are seizing the opportunity, potentially accelerating the energy transition. For example, renewables accounted for 44 percent of power generation in the European Union in the second quarter, up sharply from 37.2 percent in the same period a year earlier, according to Reuters. “We are seeing figures we weren’t expecting to see for another 10 years,” Matti Rautkivi, director of strategy and business development at Finnish energy tech group Wartsila, told Reuters.

https://oilprice.com/Energy/Energy-General/The-Pandemic-Has-Been-A-Major-Boon-For-Renewable-Energy.html

BTU Analytics - Muted Recovery? Oil Demand Outlook for the Remainder of 2020

As we enter the second half of what is proving to be a tumultuous and unprecedented year for economies generally, and oil markets in particular, let’s revisit the outlook for the remainder of 2020 for crude oil demand. The lockdowns due to the COVID-19 pandemic and corresponding economic collapse resulted in material demand destruction for crude oil – when large portions of the travelling population are homebound for months, that weighs heavily on transportation fuel demand. Global liquids’ demand in 2Q2020 fell about 20% to 81 MMb/d from the average of 99.9 MMb/d in 2019. As economies emerge from lockdowns, the sense continues to be that 2Q2020 is the bottom, and the second half of the year has an improved oil demand outlook. The question, however, is how quickly and to what extent the recovery will take.

https://btuanalytics.com/crude-oil-pricing/muted-recovery-oil-demand-outlook-for-the-remainder-of-2020/

https://btuanalytics.com/crude-oil-pricing/muted-recovery-oil-demand-outlook-for-the-remainder-of-2020/

Tuesday, July 21, 2020

JPT - Are Half the Companies in Shale Really Superfluous?

Judgment day has arrived for companies of the oil shale boom and many are looking superfluous.

That is label used by Deloitte to describe 50% of the companies in its shale universe, representing nearly half the production.

The dictionary defines superfluous as more than is needed or wanted. The accounting firm describes them as “companies with a high-risk profile, making them unnecessary bets in the current environment.”

During the current deep funk in the oil business, these companies with low grades for financial strength and operational efficiency are in jeopardy.

“The grim financial position of many companies and weak economic outlook could trigger deep consolidation in the US shale industry,” Deloitte wrote in a recent report.

Note the use of the qualifier “could” in that sentence.

https://pubs.spe.org/en/jpt/jpt-article-detail/?art=7348

That is label used by Deloitte to describe 50% of the companies in its shale universe, representing nearly half the production.

The dictionary defines superfluous as more than is needed or wanted. The accounting firm describes them as “companies with a high-risk profile, making them unnecessary bets in the current environment.”

During the current deep funk in the oil business, these companies with low grades for financial strength and operational efficiency are in jeopardy.

“The grim financial position of many companies and weak economic outlook could trigger deep consolidation in the US shale industry,” Deloitte wrote in a recent report.

Note the use of the qualifier “could” in that sentence.

https://pubs.spe.org/en/jpt/jpt-article-detail/?art=7348

URTeC 2020: Opening session speakers see industry recovering, but ESG issues loom large

Representing a milestone shift in how the conference projects itself, the virtual URTeC 2020 opened on Monday morning with a fine plenary session on the future for unconventionals, with a growing list of ESG (environmental, societal, governmental) challenges to deal with. While all participants see the E&P industry recovering over the next 18 months, the growing importance of ESG issues will require attention by publicly held companies.

https://www.worldoil.com/news/2020/7/20/urtec-2020-opening-session-speakers-see-industry-recovering-but-esg-issues-loom-large

https://www.worldoil.com/news/2020/7/20/urtec-2020-opening-session-speakers-see-industry-recovering-but-esg-issues-loom-large

World Oil - Halliburton looks beyond U.S. shale, charting a “fundamentally different course

HOUSTON (Bloomberg) --Halliburton Co. is looking away from its traditional North American heartland for sales growth as the fracking behemoth works its way through an historic oil bust.

Shares for one of the world’s biggest oilfield service providers surged more than 8% on Monday after it posted $456 million in second-quarter free cash flow -- more than double expectations. Halliburton also told investors it’s charting a “fundamentally different course” after slashing jobs and the dividend in recent months.

“As oil demand recovers, I expect the international business will continue to be a more meaningful contributor to our revenue going forward,” Chief Executive Officer Jeff Miller told analysts and investors during a conference call. “North America production is likely to remain structurally lower in the foreseeable future and has slower growth going forward.”

https://www.worldoil.com//news/2020/7/20/halliburton-looks-beyond-us-shale-charting-a-fundamentally-different-course?id=31307113

Shares for one of the world’s biggest oilfield service providers surged more than 8% on Monday after it posted $456 million in second-quarter free cash flow -- more than double expectations. Halliburton also told investors it’s charting a “fundamentally different course” after slashing jobs and the dividend in recent months.

“As oil demand recovers, I expect the international business will continue to be a more meaningful contributor to our revenue going forward,” Chief Executive Officer Jeff Miller told analysts and investors during a conference call. “North America production is likely to remain structurally lower in the foreseeable future and has slower growth going forward.”

https://www.worldoil.com//news/2020/7/20/halliburton-looks-beyond-us-shale-charting-a-fundamentally-different-course?id=31307113

Friday, July 17, 2020

Seeking Alpha - U.S. Oil Production - Bakken Will Never Be The Same Again

Summary

- Since 2017, Bakken has surprised to the upside.

- But with DAPL stuck in legal court battles and uncertainty around takeaway capacity continuing, Bakken's production base will fall.

- Lower completion activity for 2021 and beyond will result in lower projections of ~250k b/d.

- With the rest of the US shale oil basins wounded, Permian will be the only basin left to carry the US. We see Q4 2019 as peak US oil production.

World Oil - California driller files Chapter 11 on $6.1 billion of debt

HOUSTON (Bloomberg) --California Resources Corp. filed for bankruptcy, kicking off what could turn into the next wave of collapses among oil drillers and the businesses that depend on them.

The company joins more than 200 oil explorers that have filed for court protection since 2015, and more may be coming in a matter of weeks. Denbury Resources Inc. and Noble Corp. missed their July debt payments, and Chaparral Energy Inc. asked lenders for more time, setting them on course for a possible default.

With oil prices hovering around $40 a barrel, the industry simply isn’t able to support debts taken on when prices were near peak levels. California’s biggest crude producer has been weighed down by massive borrowings since its spinoff from Occidental Petroleum Corp. in late 2014, right at the start of the previous downturn in the crude market.

https://www.worldoil.com//news/2020/7/16/california-driller-files-chapter-11-on-61-billion-of-debt?id=31307113

The company joins more than 200 oil explorers that have filed for court protection since 2015, and more may be coming in a matter of weeks. Denbury Resources Inc. and Noble Corp. missed their July debt payments, and Chaparral Energy Inc. asked lenders for more time, setting them on course for a possible default.

With oil prices hovering around $40 a barrel, the industry simply isn’t able to support debts taken on when prices were near peak levels. California’s biggest crude producer has been weighed down by massive borrowings since its spinoff from Occidental Petroleum Corp. in late 2014, right at the start of the previous downturn in the crude market.

https://www.worldoil.com//news/2020/7/16/california-driller-files-chapter-11-on-61-billion-of-debt?id=31307113

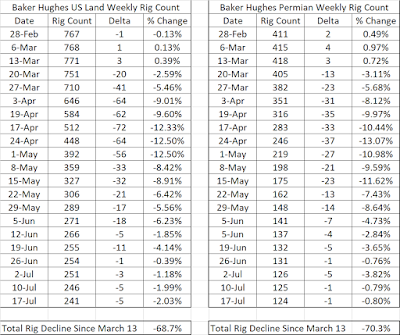

Baker Hughes US Land Weekly Rig Report - July 17 2020

The Baker Hughes Weekly Rig Report shows that US Land lost 5 rigs in the last week. The Permian, ArkLaTex and MidCon each lost one rig while the Northeast lost 2 rigs. The Eagle Ford added one rig this week. The US Land Rig Count is down 68.7% since the downturn started in March.

Over a month ago, I said that the US Land Rig Count would soon reach the bottom, but that hasn't proven to be true. The rate at which we are losing rigs has decreased from 8% to 12% losses per week down to 1% to 2% per week. Many of the small to mid-size operators dropped rigs immediately while the larger operators have made reductions more slowly. The main example is ExxonMobil. At the start of the year, ExxonMobil was running approx 55 rigs in US Land and over the last couple of months, they have reduced that to approx 30 rigs. They will probably dropped 5 to 10 more rigs throughout the remainder of the year, which will impact the overall rig count.

Over a month ago, I said that the US Land Rig Count would soon reach the bottom, but that hasn't proven to be true. The rate at which we are losing rigs has decreased from 8% to 12% losses per week down to 1% to 2% per week. Many of the small to mid-size operators dropped rigs immediately while the larger operators have made reductions more slowly. The main example is ExxonMobil. At the start of the year, ExxonMobil was running approx 55 rigs in US Land and over the last couple of months, they have reduced that to approx 30 rigs. They will probably dropped 5 to 10 more rigs throughout the remainder of the year, which will impact the overall rig count.

|

| Figure 1: Baker Hughes US Land Weekly Rig Count - July 17 2020 (Source: Baker Hughes) |

|

| Table 1: Baker Hughes US Land Weekly Rig Count - July 17 2020 (Source Baker Hughes) |

Thursday, July 16, 2020

Seeking Alpha - Saudi Arabia Dead Serious About Pushing Oil Prices Higher

Summary

- The media outlets are botching the OPEC+ agreement to taper cuts.

- Saudi's crude exports for August will be the same, so despite cuts being tapered, overall supplies will likely remain the same.

- Noncompliant producers have to also make up for the noncompliance in August and September, making headline cuts larger.

- Saudi Arabia will be only exporting ~5 mb/d in July, and with guidance from ABS that August will be the same, global crude exports will remain depressed.

- With global oil inventories starting to accelerate lower, energy stocks also have broken out.

World Oil - Shale oil production may take years to recover, despite a short-term uptick

HOUSTON (Bloomberg) --As oil prices tick up to $40 a barrel following a pandemic-induced plunge, there’s a sense the shale industry is snapping back to life with Continental Resources Inc., EOG Resources Inc. and Parsley Energy Inc. all saying they’re restarting closed wells.

But top industry forecasters are painting a far darker picture. The reopenings, they say, will do little to bring new growth to an industry being increasingly starved of cash by Wall Street after a decade of excess. Even before the pandemic, investors were demanding companies spend no more than they earn. Now, that’s become a major barrier to future growth.

Looking out 18 months, U.S. output will still be around 16% below its peak in February, according to an average of surveys from the IEA, Genscape, Enervus, Rystad and IHS Markit. It will probably be at least 2023 before the U.S. again hits its record close to 13 million barrels a day.

https://www.worldoil.com//news/2020/6/24/shale-oil-production-may-take-years-to-recover-despite-a-short-term-uptick?id=31307113

But top industry forecasters are painting a far darker picture. The reopenings, they say, will do little to bring new growth to an industry being increasingly starved of cash by Wall Street after a decade of excess. Even before the pandemic, investors were demanding companies spend no more than they earn. Now, that’s become a major barrier to future growth.

Looking out 18 months, U.S. output will still be around 16% below its peak in February, according to an average of surveys from the IEA, Genscape, Enervus, Rystad and IHS Markit. It will probably be at least 2023 before the U.S. again hits its record close to 13 million barrels a day.

https://www.worldoil.com//news/2020/6/24/shale-oil-production-may-take-years-to-recover-despite-a-short-term-uptick?id=31307113

World Oil - Digital completion system integrates OFS data to increase fracing efficiency, lowering operational costs

This year’s tumultuous drop in crude oil prices is one of the worst in our industry’s history. Although WTI began the year in the $60/bbl range, the combination of a nasty price war between Saudi Arabia and Russia, the COVID-19-induced global demand crash, and a lack of storage capacity caused crude futures to plunge 300%, to minus $37.63/bbl in mid-April. Although prices have recovered since then, thanks in part to an agreement between Saudi Arabi and Russia plus rising demand in China, they remain too low to encourage drilling activity. Uncertainty regarding the pandemic and future demand, coupled with high global inventories and spare production capacity, put forecasts for WTI at approximately $40/bbl for the remainder of the year.

https://www.worldoil.com//magazine/2020/july-2020/special-focus/digital-completion-system-integrates-ofs-data-to-increase-fracing-efficiency-lowering-operational-costs?id=31307113

https://www.worldoil.com//magazine/2020/july-2020/special-focus/digital-completion-system-integrates-ofs-data-to-increase-fracing-efficiency-lowering-operational-costs?id=31307113

Wednesday, July 15, 2020

JPT - A Double Vision: Service Companies Aim To Save Shale Dollars With Simultaneous Completions

This past April in Texas, Schlumberger was asked by a client to do something it had never done before: hydraulically fracture two multistage horizontal wells at the same time using only a single pressure-pumping fleet.

When the experiment was over, Schlumberger had completed the wells 10 days earlier than it would have by using a standard zipper fracture approach. For the client—a pure-play Eagle Ford Shale producer named Sundance Energy—the approach removed about $500,000 from the total project cost.

The industry’s largest provider of well stimulation services by total horsepower calls the tactic simultaneous fracturing. Other service companies are touting the approach too, sometimes using less formal names that include “dual-stim,” “simul-stim,” and “double-barrel fracturing.”

For shale producers, the ability to pump two wells using roughly the same equipment spread it takes to stimulate one offers a clear route to achieving savings at scale on rental and personnel costs.

For the North American service companies, the emerged method represents a new way to win work amidst a historically tight pressure-pumping market.

https://pubs.spe.org/en/jpt/jpt-article-detail/?art=7338

When the experiment was over, Schlumberger had completed the wells 10 days earlier than it would have by using a standard zipper fracture approach. For the client—a pure-play Eagle Ford Shale producer named Sundance Energy—the approach removed about $500,000 from the total project cost.

The industry’s largest provider of well stimulation services by total horsepower calls the tactic simultaneous fracturing. Other service companies are touting the approach too, sometimes using less formal names that include “dual-stim,” “simul-stim,” and “double-barrel fracturing.”

For shale producers, the ability to pump two wells using roughly the same equipment spread it takes to stimulate one offers a clear route to achieving savings at scale on rental and personnel costs.

For the North American service companies, the emerged method represents a new way to win work amidst a historically tight pressure-pumping market.

https://pubs.spe.org/en/jpt/jpt-article-detail/?art=7338

World Oil - Global E&P mid-year spending outlook: Collapse underway

Overproduction by Saudi Arabia and Russia in March and April, and the accompanying oil price crash before the OPEC+ deal was reached, have taken their toll on the 2020 capital spending outlook. Here, at Evercore ISI, we forecast global E&P expenditures will decline 27% in 2020, a 3,000-bps (basis point) turnaround from the 2% increase in spending anticipated in our December survey.

https://www.worldoil.com//magazine/2020/july-2020/features/global-ep-mid-year-spending-outlook-collapse-underway?id=31307113

https://www.worldoil.com//magazine/2020/july-2020/features/global-ep-mid-year-spending-outlook-collapse-underway?id=31307113

Tuesday, July 14, 2020

World Oil - OPEC projects oil demand exceeding pre-virus levels in 2021

LONDON (Bloomberg) - OPEC expects demand for its crude oil to rebound sharply next year, surpassing levels seen before the coronavirus crisis, as rival producers struggle to revive output.

The Organization of Petroleum Exporting Countries forecasts the need for its crude will surge by 25% in 2021 to average 29.8 MMbpd, higher than the level required in 2019, according to a monthly report.

While the increase is partly driven by a recovery in global oil demand as economic growth resumes, an even bigger factor is the misfortune of OPEC’s competitors. After slumping 7.4% this year, the U.S. will see only limited production growth in 2021, the report showed.

In the meantime, OPEC and its allies are cutting production to clear the glut left behind by the Covid-19 crisis and prop up prices. The cartel said it implemented more than 100% of the cutbacks pledged in June.

https://www.worldoil.com/news/2020/7/14/opec-projects-oil-demand-exceeding-pre-virus-levels-in-2021

The Organization of Petroleum Exporting Countries forecasts the need for its crude will surge by 25% in 2021 to average 29.8 MMbpd, higher than the level required in 2019, according to a monthly report.

While the increase is partly driven by a recovery in global oil demand as economic growth resumes, an even bigger factor is the misfortune of OPEC’s competitors. After slumping 7.4% this year, the U.S. will see only limited production growth in 2021, the report showed.

In the meantime, OPEC and its allies are cutting production to clear the glut left behind by the Covid-19 crisis and prop up prices. The cartel said it implemented more than 100% of the cutbacks pledged in June.

https://www.worldoil.com/news/2020/7/14/opec-projects-oil-demand-exceeding-pre-virus-levels-in-2021

World Oil - Biden says fracing “not on the chopping block” in his $2 trillion climate plan

WASHINGTON (Bloomberg) --Joe Biden on Tuesday will unveil clean-energy and infrastructure plans that seek to balance progressives’ demands for bold action on climate against protecting swing-state jobs in a coronavirus-altered economy.

Biden’s plan includes $2 trillion in spending over four years and sets the goal of a 100% clean-energy standard by 2035, people briefed on the proposals said. That’s more spending over a shorter period than the $1.7 trillion, 10-year plan that Biden had offered during the Democratic primary.

The proposal is another key element of Biden’s broader plan to pull the U.S. out of the recession touched off by the pandemic as he builds his argument into the November election against President Donald Trump. With the energy plan, the Democratic nominee will seek to both revive the economy and address deeper systemic problems that existed before the virus hit.

https://www.worldoil.com/news/2020/7/14/biden-says-fracing-not-on-the-chopping-block-in-his-2-trillion-climate-plan

Biden’s plan includes $2 trillion in spending over four years and sets the goal of a 100% clean-energy standard by 2035, people briefed on the proposals said. That’s more spending over a shorter period than the $1.7 trillion, 10-year plan that Biden had offered during the Democratic primary.

The proposal is another key element of Biden’s broader plan to pull the U.S. out of the recession touched off by the pandemic as he builds his argument into the November election against President Donald Trump. With the energy plan, the Democratic nominee will seek to both revive the economy and address deeper systemic problems that existed before the virus hit.

https://www.worldoil.com/news/2020/7/14/biden-says-fracing-not-on-the-chopping-block-in-his-2-trillion-climate-plan

Rystad Energy - If DAPL pipeline shuts down, hundreds of thousands of US oil barrels will lack an exit route in 2020

A US district court has ruled that the largest outbound Bakken pipeline – the Dakota Access Pipeline or DAPL – shall be emptied within 30 days. If this decree remains in place, hundreds of thousands of produced barrels per day will lack an export route in 2020, Rystad Energy estimates, as alternative options such as other existing pipelines or railway transportation will not be able to fully take on the burden until next year.

If we assume that DAPL is unavailable for transportation from August 2020 and that rail exports remain at 300,000 bpd, that leaves around 750,000 bpd of available pipeline capacity (assuming maximum utilization) and local refining demand. Initially, this sounds like more than enough to absorb the 900,000 bpd of Bakken oil production from May 2020.

However, we must remember that production declines in April and May were predominantly driven by curtailments; most of these volumes will come back during the summer, assuming that a $40 WTI environment persists. The reactivation of curtailments will likely push statewide oil output back to an average of 1.2 million bpd in 2H20. Hence, with 300,000 bpd rail exports, remaining pipelines and local refineries alone will need to absorb 900,000 bpd of production.

https://www.rystadenergy.com/newsevents/news/press-releases/if-dapl-pipeline-shuts-down-hundreds-of-thousands-of-us-oil-barrels-will-lack-an-exit-route-in-2020/

If we assume that DAPL is unavailable for transportation from August 2020 and that rail exports remain at 300,000 bpd, that leaves around 750,000 bpd of available pipeline capacity (assuming maximum utilization) and local refining demand. Initially, this sounds like more than enough to absorb the 900,000 bpd of Bakken oil production from May 2020.

However, we must remember that production declines in April and May were predominantly driven by curtailments; most of these volumes will come back during the summer, assuming that a $40 WTI environment persists. The reactivation of curtailments will likely push statewide oil output back to an average of 1.2 million bpd in 2H20. Hence, with 300,000 bpd rail exports, remaining pipelines and local refineries alone will need to absorb 900,000 bpd of production.

https://www.rystadenergy.com/newsevents/news/press-releases/if-dapl-pipeline-shuts-down-hundreds-of-thousands-of-us-oil-barrels-will-lack-an-exit-route-in-2020/

Friday, July 10, 2020

Baker Hughes Weekly US Land Rig Report - Jul 10 2020

The Baker Hughes Rig Count showed that rigs in US Land dropped by another 5 rigs this week for a total of 246 active rigs. The Eagle Ford lost 3 rigs this week and the the Permian and MidCon each lost 1 rig.

The rig count continues to fall at a much lower rate than the height of the downturn. As the quarterly earnings reports come out, we should be able to see what drilling plans will be for the last half of 2020 and the start of 2021

The rig count continues to fall at a much lower rate than the height of the downturn. As the quarterly earnings reports come out, we should be able to see what drilling plans will be for the last half of 2020 and the start of 2021

|

| Table 1: Baker Hughes Weekly US Land Rig Count - July 10 2020 (Source: Baker Hughes) |

|

| Figure 1: Baker Hughes Weekly US Land Rig Count - July 10 2020 (Source: Baker Hughes) |

Thursday, July 9, 2020

What happened to Open Hole Logging in US Land?

I started my career as an open hole field engineer for Schlumberger in Brooks Alberta in 1998. I logged hundreds of wells all over Western Canada, switched to Cased Hole, worked offshore, managed a wireline district with open hole logging and and I've been involved in Open Hole Wireline sales. I always enjoy talking about logging and looking at logs. In the last decade, open hole logging has become less important due to a few factors and it's disappointing to see that open hole logging is becoming a forgotten skill.

Figure 1 shows an example of a wireline logging run. The tools have been lowered to the bottom of the well on wireline and are recording data as they are being pulled out of the well. There are many different types of measurements that can be recorded but the main goal of an open hole log is to identify the hydrocarbon bearing zones (also known as the pay zone).

Maybe I'm just getting old and I should move on. Maybe I'll be the old guy telling logging war stories to the young pups who never ran an open hole run. Back in the day, open hole logging was one of the main points of the process of drilling a new well. The hours were terrible and the conditions were bad but the pay was usually very good. In this post, I'll give brief overview of open hole logging and why open hole logging less important than it used to be.

For readers who don't know what an open hole log is, the basic idea is that when an oil and gas well is drilled, a package of sensors (known as logging tools) is attached to a wire (aka wireline) and those sensors are lowered to the bottom of the well. Once at the bottom of the well, the wireline is pulled out of the hole and the sensors record data along the entire length off the well. The wireline provided power to the tools and a way to send data to the computer in the logging truck. The recorded data is printed on a continuous piece of paper versus the depth of the well and is known as a well log.

|

| Figure 1: Example of Wireline Logging (Source: Crain's Petrophysical Handbook) |

|

| Figure 2: Example of an Open Hole Log (Source: Schlumberger) |

Figure 1 shows an example of a wireline logging run. The tools have been lowered to the bottom of the well on wireline and are recording data as they are being pulled out of the well. There are many different types of measurements that can be recorded but the main goal of an open hole log is to identify the hydrocarbon bearing zones (also known as the pay zone).

Figure 2 shows an example of an open hole log that has been interpreted to identify the pay zones in the well. The open hole log analyst/interpreter should be able to evaluate the data, determine if the data is accurate and make a decision if the well should be kept for production or abandoned due to poor hydrocarbon shows. Before easy transmission of large data sets, this decision was made at the wellsite during the logging run (usually at night or some early hour of the morning).

The following chart from Spears & Associates shows the US Open Hole Wireline revenue since 2011

From 2011 to 2014, US Land Open Hole Revenue averaged $767 million per year. During the downturn of 2015 to 2016, US Land Open Hole Revenue dropped to a low of $178 million in 2016. There was a slight increase in revenue in 2017 as rig count recovered but total open hole revenue never returned to previous levels.

Figure 4 looks at Open Hole Revenue per Rig in US land. Open Hole revenue is dependent on rig count because 99.999% of open hole revenue is generated from logging new wells.

The revenue per rig from 2011 to 2014 averaged $411,000 per active rig. Revenue per rig spiked up in 2016 as the rig count dropped but activity began to recover. From 2017 to 2019, Open Hole Revenue per Rig averaged $252,000 per rig, a 38% decrease from the average before the downturn.

So why have has there been a reduction in open hole logging. I think there are several reasons we can point too.

The first reason is that in the past, logging vertical wells was easy* compared to horizontal logging. You lowered the logging tools into the well, reached the bottom of the well and started recording data as you pulled out of the hole.

(*open hole logging was never easy. If you commented that it was easy, karma usually showed up and crushed you)

Logging Horizontal wells is much more difficult. The logging tools cannot reply on gravity to carry them to the bottom of the well. The tools must be pushed by drill pipe to the bottom of the well and they must remain connected to the wireline at the same time. Drill Pipe Conveyed logging in horizontal wells is much more difficult, dangerous and expensive when compared to vertical logging

Traditional open hole logging companies were slow to evolve with the changing market. During the initial stages of growth in horizontal drilling, traditional wireline tools were deployed so that operators could identify the target zone, determine the properties of the rock in the target zone and identify changes along the lateral. As horizontal drilling matured, operators required fewer measurements and open hole logging revenues began to drop.

Figure 5 shows that the percentage of vertical wells and horizontal wells were the same in May 2009. Going back to Figure 3, Open Hole logging revenues didn't decrease until 2015. The open hole logging market evolved through small start up companies like ThruBit, Cordax and Weatherford. These innovative technologies replaced traditional horizontal logging runs with equipment that could be deployed safely, efficiently and at a much lower cost.

The second reason for a permanent decrease in open hole logging revenue occurred during the downturn of 2015 and 2016. During this downturn, operators cut costs where ever they could, including both vertical and horizontal logging runs. What the operators discovered is that they didn't need logs to make better wells, they could increase the size of the frac job (stages, perfs and proppant) and create better wells.

This discovery changed the mindset of the industry, resulting in very few horizontal logging runs during the downturn and a permanent decrease in open hole logging revenues since then. Completion engineers and frac companies continued to evolve frac designs through trial and error, measuring success by the initial production of the well.

The third reason for the loss of open hole logging revenue was the nearly complete switch to horizontal drilling. Figure 6 revisits the Revenue per rig but includes horizontal rig count with total rig count.

Figure 6 shows that there were significantly fewer vertical rigs working after the downturn. From 2017 to today, 86% of the rigs working in US Land were horizontal drilling rigs. The open hole logging industry faced a double whammy coming out of the downturn. Horizontal Open Hole Logs were deemed ineffective and too expensive during the downturn and there were very few vertical wells to log. This has resulted in a permanent loss of revenue and expertise in the industry.

Based on the current state of the industry, open hole logging activity is likely not to return. The ability to interpret open hole logs is turning into a lost art and the older generation that interpreted open hole logs are retiring.

I still think there is a place for measurements in horizontal wells but there are other ways to acquire them. Technologies like Drill2Frac and Lateral Science use data from the drill bit to determine changes in rock properties along the lateral. Since the this data is already acquired while the lateral is drilled, this data can be used at any point during the life cycle of the well. I think the ability to evaluate rock properties will be very important in later stages of a wells life when refracing becomes an option.

The following chart from Spears & Associates shows the US Open Hole Wireline revenue since 2011

|

| Figure 3: US Open Hole Wireline Revenue (Source: Spears & Associates Wireline Market Report Q2 2020) |

From 2011 to 2014, US Land Open Hole Revenue averaged $767 million per year. During the downturn of 2015 to 2016, US Land Open Hole Revenue dropped to a low of $178 million in 2016. There was a slight increase in revenue in 2017 as rig count recovered but total open hole revenue never returned to previous levels.

Figure 4 looks at Open Hole Revenue per Rig in US land. Open Hole revenue is dependent on rig count because 99.999% of open hole revenue is generated from logging new wells.

|

| Figure 4: US Land Open Hole Revenue per Rig (Source: Baker Hughes Rig Count, Spears & Associates Q2 2020 Wireline Market Report) |

So why have has there been a reduction in open hole logging. I think there are several reasons we can point too.

The first reason is that in the past, logging vertical wells was easy* compared to horizontal logging. You lowered the logging tools into the well, reached the bottom of the well and started recording data as you pulled out of the hole.

(*open hole logging was never easy. If you commented that it was easy, karma usually showed up and crushed you)

Logging Horizontal wells is much more difficult. The logging tools cannot reply on gravity to carry them to the bottom of the well. The tools must be pushed by drill pipe to the bottom of the well and they must remain connected to the wireline at the same time. Drill Pipe Conveyed logging in horizontal wells is much more difficult, dangerous and expensive when compared to vertical logging

Traditional open hole logging companies were slow to evolve with the changing market. During the initial stages of growth in horizontal drilling, traditional wireline tools were deployed so that operators could identify the target zone, determine the properties of the rock in the target zone and identify changes along the lateral. As horizontal drilling matured, operators required fewer measurements and open hole logging revenues began to drop.

|

| Figure 5: Baker Hughes Weekly US Land Rig Count (Source: Baker Hughes) |

Figure 5 shows that the percentage of vertical wells and horizontal wells were the same in May 2009. Going back to Figure 3, Open Hole logging revenues didn't decrease until 2015. The open hole logging market evolved through small start up companies like ThruBit, Cordax and Weatherford. These innovative technologies replaced traditional horizontal logging runs with equipment that could be deployed safely, efficiently and at a much lower cost.

The second reason for a permanent decrease in open hole logging revenue occurred during the downturn of 2015 and 2016. During this downturn, operators cut costs where ever they could, including both vertical and horizontal logging runs. What the operators discovered is that they didn't need logs to make better wells, they could increase the size of the frac job (stages, perfs and proppant) and create better wells.

This discovery changed the mindset of the industry, resulting in very few horizontal logging runs during the downturn and a permanent decrease in open hole logging revenues since then. Completion engineers and frac companies continued to evolve frac designs through trial and error, measuring success by the initial production of the well.

The third reason for the loss of open hole logging revenue was the nearly complete switch to horizontal drilling. Figure 6 revisits the Revenue per rig but includes horizontal rig count with total rig count.

|

| Figure 6: Open Hole Logging Revenue per Rig with Total and Horizontal Rigs (Source: Baker Hughes Rig Count, Spears & Associates Q2 2020 Wireline Market Report) |

Based on the current state of the industry, open hole logging activity is likely not to return. The ability to interpret open hole logs is turning into a lost art and the older generation that interpreted open hole logs are retiring.

I still think there is a place for measurements in horizontal wells but there are other ways to acquire them. Technologies like Drill2Frac and Lateral Science use data from the drill bit to determine changes in rock properties along the lateral. Since the this data is already acquired while the lateral is drilled, this data can be used at any point during the life cycle of the well. I think the ability to evaluate rock properties will be very important in later stages of a wells life when refracing becomes an option.

Tuesday, July 7, 2020

Forbes - How Two Young Scientists Built a $250 Million Business Using Yeast to Clean Up Wastewater

A long-standing poker game with a group of University of Texas Southwestern medical students in Dallas brought Gaurab Chakrabarti and Sean Hunt together. Wenly Ruan, Chakrabarti’s dissection lab partner and Hunt’s then-girlfriend (now wife), was the link. But soon Chakrabarti, an M.D./Ph.D. (or “Mud-Phud,” in medical school parlance) candidate researching a drug candidate for pancreatic cancer, and Hunt, a graduate student in chemical engineering at MIT, were geeking out over science.

“Sean was terrible at poker,” says Chakrabarti, now 31. Though Hunt kept losing, he continued to play for years, as he returned to Dallas from Boston to visit Ruan. And as they played, Chakrabarti and Hunt continued their geek-out. Chakrabarti was researching enzymes found in cancer cells that produce hydrogen peroxide, and he wondered if that process might apply to Hunt’s research on improving traditional chemical manufacturing. Hunt scoffed at the idea. “I was, like, ‘There’s no way an enzyme could be used in an industrial, long-scale chemical process,’” recalls Hunt, also 31. “But as we kept talking and diving into it, Gaurab convinced me.”

https://www.forbes.com/sites/alexknapp/2020/07/06/how-two-young-scientists-built-a-250-million-business-using-yeast-to-clean-up-wastewater/#2a405b4f7802

“Sean was terrible at poker,” says Chakrabarti, now 31. Though Hunt kept losing, he continued to play for years, as he returned to Dallas from Boston to visit Ruan. And as they played, Chakrabarti and Hunt continued their geek-out. Chakrabarti was researching enzymes found in cancer cells that produce hydrogen peroxide, and he wondered if that process might apply to Hunt’s research on improving traditional chemical manufacturing. Hunt scoffed at the idea. “I was, like, ‘There’s no way an enzyme could be used in an industrial, long-scale chemical process,’” recalls Hunt, also 31. “But as we kept talking and diving into it, Gaurab convinced me.”

https://www.forbes.com/sites/alexknapp/2020/07/06/how-two-young-scientists-built-a-250-million-business-using-yeast-to-clean-up-wastewater/#2a405b4f7802

Forbes - The Next Paradigm For Oil Is Here

The U.S. tight oil rig count is about 25% of what is needed to maintain 2019 levels of tight and total oil production. As U.S. supply plunges, the over-supply paradigm of the last 5 years may finally change.

The U.S. tight oil rig count is now 155 (Figure 1). About 600 rigs are needed to maintain tight oil production at 7 mmb/d and U.S. total output at 12 mmb/d. That means that tight oil will irreversibly fall to less than 5 mmb/d and U.S. to less than 8 mmb/d by mid-2021.

https://www.forbes.com/sites/arthurberman/2020/07/06/the-next-paradigm-for-oil/#2f1c6ef76c8b

The U.S. tight oil rig count is now 155 (Figure 1). About 600 rigs are needed to maintain tight oil production at 7 mmb/d and U.S. total output at 12 mmb/d. That means that tight oil will irreversibly fall to less than 5 mmb/d and U.S. to less than 8 mmb/d by mid-2021.

https://www.forbes.com/sites/arthurberman/2020/07/06/the-next-paradigm-for-oil/#2f1c6ef76c8b

Monday, July 6, 2020

Seeking Alpha - Antero Resources Is Making Money Its Way

Summary

- A $300 million initial cash payment was received on an overriding royalty.

- The company continues to repurchase bonds at a 17% second-quarter discount.

- The maturity of the 2021 bonds is no longer an issue.

- The company continues to make money in nontraditional ways.

- Industry activity has dropped below levels previously forecast.

RigZone - Oil Group Responds to New Texas Covid Rules

Texas Oil and Gas Association (TXOGA) President Todd Staples has supported Texas Governor Greg Abbott’s latest Covid-19 rules, which came into effect on July 3.

“Governor Abbott is striking the right balance in establishing policy that will keep our economy moving while slowing the spread of Covid-19,” Staples said in a statement sent to Rigzone.

“Hospitalization rates are increasing substantially, so it is absolutely imperative we heighten the measures to protect our citizens and promote growth of jobs simultaneously,” he added.

https://www.rigzone.com/news/oil_group_responds_to_new_texas_covid_rules-06-jul-2020-162637-article/

“Governor Abbott is striking the right balance in establishing policy that will keep our economy moving while slowing the spread of Covid-19,” Staples said in a statement sent to Rigzone.

“Hospitalization rates are increasing substantially, so it is absolutely imperative we heighten the measures to protect our citizens and promote growth of jobs simultaneously,” he added.

https://www.rigzone.com/news/oil_group_responds_to_new_texas_covid_rules-06-jul-2020-162637-article/

Rystad Energy - Modelling a second Covid-19 wave: Oil demand in 2020 could lose another 2.5 million bpd

As the number of confirmed new Covid-19 cases surges to new global highs of beyond 200,000 per day, a second wave of the pandemic is increasingly apparent in several countries – most notably in the United States. Modelling the effect of a wider ‘second wave’ scenario, Rystad Energy finds that global oil demand in 2020 could be knocked down to 86.5 million bpd, compared to our current base-case estimate of 89 million bpd.

In the second wave scenario, we don’t expect the oil demand impact to be as strong as was seen in the first outbreak, as restrictive measures will be limited to particular regions and sectors. We would expect these “smart lockdowns” to lower the negative demand impact, so as not to repeat the absolute low of 73.7 million bpd in April. The maximum negative demand impact in April 2020 was -26 million bpd, and the peak month in the second wave could come close to this at -18 million bpd, compared to the levels projected prior to the pandemic. We will be revisiting and updating these assumptions as data becomes available.

https://www.rystadenergy.com/newsevents/news/press-releases/modelling-a-second-covid-19-wave-oil-demand-in-2020-could-lose-another-2p5-million-bpd/

In the second wave scenario, we don’t expect the oil demand impact to be as strong as was seen in the first outbreak, as restrictive measures will be limited to particular regions and sectors. We would expect these “smart lockdowns” to lower the negative demand impact, so as not to repeat the absolute low of 73.7 million bpd in April. The maximum negative demand impact in April 2020 was -26 million bpd, and the peak month in the second wave could come close to this at -18 million bpd, compared to the levels projected prior to the pandemic. We will be revisiting and updating these assumptions as data becomes available.

https://www.rystadenergy.com/newsevents/news/press-releases/modelling-a-second-covid-19-wave-oil-demand-in-2020-could-lose-another-2p5-million-bpd/

Friday, July 3, 2020

Baker Hughes Weekly US Land Rig Count - July 2 2020

The Baker Hughes Weekly Rig Count showed that the US Land rig count was 251 rigs this week, down 3 rigs from the previous week. After a very brief slow down in the reduction of the rigs, the Permain basin led the losses this week, losing 5 rigs. The ArkLaTex and Powder River Basin each added one rig.

|

| Figure 1: Baker Hughes US Land Weekly Rig Count - July 2 2020 (Source: Baker Hughes) |

|

| Table 1: Baker Hughes US Land Weekly Rig Count - July 2 2020 (Source: Baker Hughes) |

Wednesday, July 1, 2020

OilPrice.com - $40 Oil Isn’t Enough To Prevent A Wave Of Shale Bankruptcies

The coronavirus pandemic and the oil price collapse are accelerating the pace of bankruptcy filings in the U.S. shale patch this year. The number of filings had already started to trend up in 2019 after a drop in prices in Q4 2018, but this year, the U.S. energy industry is setting some grim records as indebted cash-strapped producers face a day of reckoning from the borrowing exuberance of the past years.

So far this year, bankruptcies in the U.S. energy industry have exceeded 20 filings from companies with more than US$50 million in liabilities. This is the highest number of first-half filings for protection from creditors since the first half of 2016, during the previous oil price collapse, according to data compiled by Bloomberg. In June alone, seven oil and gas companies filed for Chapter 11, matching the record from the monthly peak in bankruptcy filings set in April 2016.

https://oilprice.com/Energy/Energy-General/40-Oil-Isnt-Enough-To-Prevent-A-Wave-Of-Shale-Bankruptcies.html

So far this year, bankruptcies in the U.S. energy industry have exceeded 20 filings from companies with more than US$50 million in liabilities. This is the highest number of first-half filings for protection from creditors since the first half of 2016, during the previous oil price collapse, according to data compiled by Bloomberg. In June alone, seven oil and gas companies filed for Chapter 11, matching the record from the monthly peak in bankruptcy filings set in April 2016.

https://oilprice.com/Energy/Energy-General/40-Oil-Isnt-Enough-To-Prevent-A-Wave-Of-Shale-Bankruptcies.html

Seeking Alpha - Natural Gas - A Messy Bottom

Summary

https://seekingalpha.com/article/4356457-natural-gas-messy-bottom

- Hotter weather over the weekend combined with no increase in Lower 48 production propelled natural gas prices up by ~10%.

- September should see LNG exports from the US rebound thanks to better economics.

- But the bottom is messy because the market's concern about US storages getting close to tank top needs to go away first.

- The market will do everything in its power to avoid the tank top scenario even if it means that it overly discounts prices in the near term.

- As a result, the key ingredients for higher prices are still hotter weather and lower production, so if these two variables continue to trend in the same direction, expect us to turn into bulls.

https://seekingalpha.com/article/4356457-natural-gas-messy-bottom

Subscribe to:

Comments (Atom)